When budgeting for a new construction home, one of the most important — and often misunderstood — expenses to plan for is closing costs. Understanding what closing costs are, who pays them, and how builder-paid closing cost incentives work can help you make smarter financial decisions when buying a new home.

What are Closing Costs?

Closing costs are the fees and expenses required to finalize the purchase of a home. These costs are paid at closing, when ownership of the property transfers from the seller (the builder) to the buyer.

Most closing costs are not related to the construction of the home. Instead, they are tied to:

“At the most basic level, it costs money to borrow money. Closing costs allow the lender and title company to do their jobs.”

— Mikaela Vaughn, New Home Sales Agent

Common examples of Closing Costs:

Typical closing costs may include:

-

Mortgage origination fees

-

Appraisal fees

-

Prepaid items and lender fees

-

Escrow or settlement fees

-

Prorated property taxes

-

Survey fees

-

Owner’s Title Policy (OTP)

-

Title search and title company fees

-

Recording and government fees

These fees do not go to the home builder, and they are not caused by buying a new construction home.

Are There Other Costs Due at Closing?

Yes. In addition to standard closing costs, buyers may also be responsible for:

These costs vary by community and are separate from lender-related fees.

Who Typically Pays Closing Costs?

In most transactions, buyers pay the majority of closing costs, because they are directly associated with the mortgage loan.

However, federal lending guidelines allow sellers (including builders) to contribute a limited amount toward closing costs, depending on loan type:

Your lender determines the exact allowable amount based on your loan program.

What Are Builder-Paid Closing Costs?

Builder-paid closing costs are often offered as a Builder Concession — an incentive that helps reduce a buyer’s upfront expenses.

When Are Builder Concessions Available?

If available, your New Home Sales Agent can help you apply the concession toward:

How Builder Paid Closing Costs Are Written in the Contract

Your new home contract will typically state seller-paid closing costs as:

“Up to and not exceeding $X”

This wording protects both buyer and seller. For example:

-

If the contract states “up to $2,000”

-

And allowable seller contributions total $1,997.42

-

The contract does not need to be amended

Any small variance is already accounted for in the overall concession — no value is lost.

Additional Savings With Preferred Lenders

Buyers may qualify for additional savings by using one of the builder’s preferred lenders.

Omega Builders Preferred Lender Savings Include:

Using an Omega Builders preferred lender can significantly reduce your out-of-pocket costs at closing.

Discover why you need title insurance and what it covers from CentraLand Title Company.

How Much Are Closing Costs on a New Home?

Closing costs typically range between:

2%–5% of the home’s purchase price

The exact amount depends on:

-

Loan type

-

Purchase price

-

Local taxes and fees

Before closing, your lender will provide a Closing Disclosure, which outlines:

Helpful Tools to Estimate Closing Costs

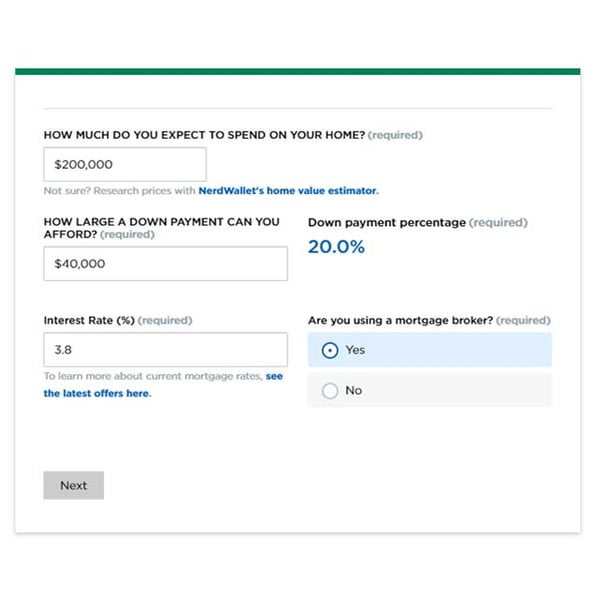

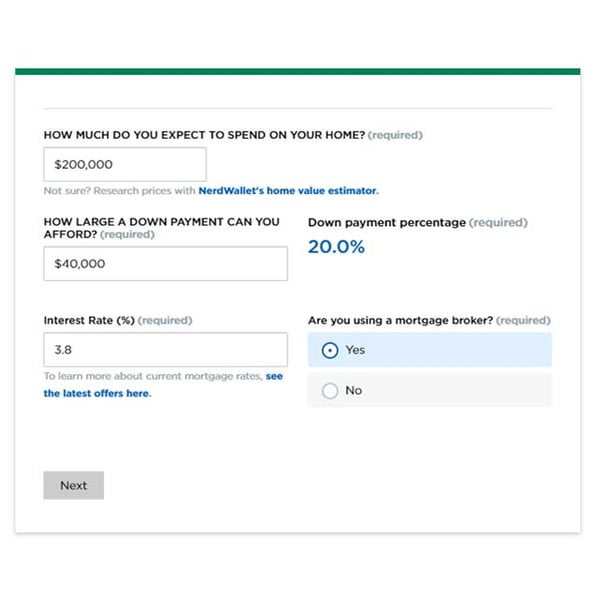

Online tools, such as the NerdWallet Closing Cost Calculator, can help you estimate costs early in the buying process and understand how different loan options affect your total. Closing Cost Calculator as shown on Nerdwallet.com

Closing Cost Calculator as shown on Nerdwallet.com

Key Takeaways About Builder Paid Closing Costs

-

Closing costs are mostly lender and title-related fees

-

Builders do not collect closing costs

-

Seller contributions are limited by loan type

-

Builder concessions can reduce upfront expenses

-

Preferred lenders may offer additional savings

Frequently Asked Questions About Builder Paid Closing Costs

What are builder-paid closing costs?

Builder-paid closing costs are seller concessions offered by a home builder to help cover a buyer’s allowable closing costs. These incentives reduce the buyer’s out-of-pocket expenses at closing but are limited by loan type and federal lending guidelines.

Do builders always pay closing costs on new construction homes?

No. Builder-paid closing costs are not guaranteed. Availability depends on market conditions, inventory levels, and current incentives. In highly competitive markets, builder concessions may be limited or unavailable.

Are closing costs higher on new construction homes?

No. Closing costs for new construction homes are generally the same as resale homes. Most closing costs are related to the mortgage loan, title services, and government fees—not the age of the home.

How much can a builder contribute toward closing costs?

Builder contributions are capped based on loan type:

Your lender determines the exact allowable amount.

Can builder concessions be used for upgrades instead of closing costs?

Yes. Builder concessions may be applied toward options and upgrades, which can help keep your loan amount lower and reduce long-term interest costs. Your New Home Sales Agent can help determine the best use of available concessions.

What does “up to and not exceeding” mean in a builder contract?

This language means the builder will pay no more than the stated amount toward allowable closing costs. If the final total is slightly less than the maximum, the contract does not need to be amended, and no benefit is lost.

Do builder-paid closing costs reduce my loan amount?

They can. Using concessions for upgrades or prepaid costs can reduce the amount you need to borrow, which may lower your monthly payment and overall interest paid over time.

Are there extra savings when using a preferred lender?

Yes. Buyers who choose a builder’s preferred lender may receive additional incentives, such as:

-

Paid survey fees

-

Paid Owner’s Title Policy

These savings can total $1,000–$3,000 or more, depending on the home’s price.

Who actually receives the closing cost fees?

Closing cost fees are paid to third parties, including lenders, title companies, appraisers, and government agencies. Builders do not collect these fees.

How will I know my exact closing costs before closing?

Your lender will provide a Closing Disclosure prior to closing that lists:

This document allows you to review and confirm all costs before signing.

Can closing costs be rolled into my mortgage?

In most cases, closing costs cannot be rolled into a purchase loan unless allowed by specific loan programs or covered by seller concessions. Your lender can explain your available options.

This article is provided for informational purposes only. Omega does not warrant or guarantee the accuracy of the information provided and makes no representations associated with the use of this information as it is not intended to constitute financial, legal, tax, or mortgage lending advice. Omega Builders encourages you to seek the advice of professionals in making any determination regarding, financial, legal, tax, or mortgage decisions as only an informed professional can appropriately advise you based upon the circumstances unique to your situation.